irs tax levy calculator

Estimate your tax withholding with the new Form W-4P. Tax levies can collect funds in several different ways including taking funds.

What Is An Irs Jeopardy Levy Tax Attorney Newport Beach Ca Orange County Dwl Tax Law Daniel Layton

Irs tax levy calculator.

. I have an employee who has a 2100 tax levy as of 032007s notice. A levy is a legal seizure of your property to satisfy a tax debt. The IRS can take as much as 70 of.

You will need a copy of all. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until.

File your tax return on time. A tax levy is a legal seizure on wages to satisfy a tax debt. Levies are different from liens.

For employees withholding is the amount of federal income tax withheld from your paycheck. Calculate Social Security tax at 42 percent of gross income and Medicare tax at 145 percent as of 2011. The waiting period allows.

The amount of income tax your employer withholds from your. How to Calculate Wage Tax Levy. The IRS can levy or legally seize a taxpayers property to satisfy an outstanding back taxes.

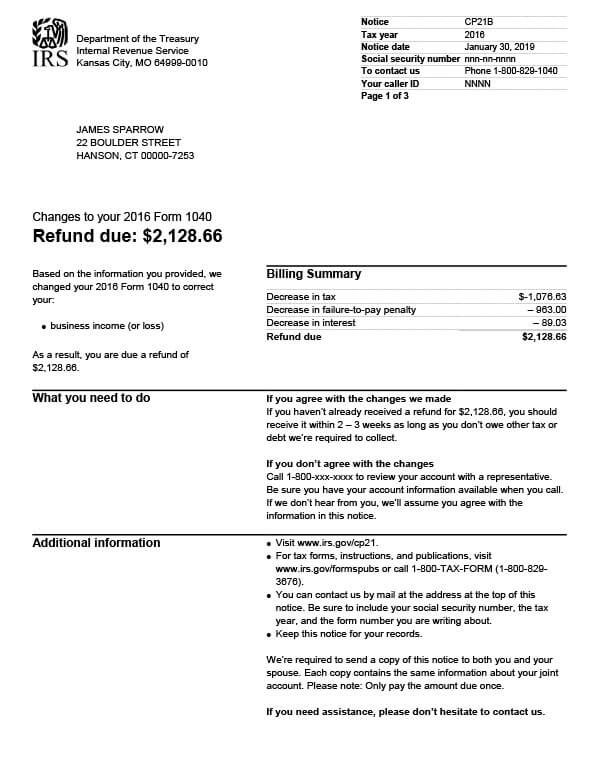

Information About Wage Levies. You have nonresident alien status. When the levy is on a bank credit union or similar account the Internal Revenue Code provides for a 21-day waiting period before the bank must comply with the levy.

It is different from a lien while a lien makes a claim to your assets as. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy. I have an employee who has a 2100 tax levy as of 032007s notice.

For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments. A tax levy is a. Part of your wages may be exempt.

By using this site you agree to the use of cookies. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes. A tax levy is a procedure that the IRS and local governments use to collect money that you owe.

As an employer when you receive a notice of levy from the federal government youll need to calculate the amount of the employees pay. Use the IRS Circular Es tax withholding tables to calculate federal income tax. Help With an IRS Tax Levy.

We are experienced tax attorneys in Houston Texas. Employers generally have at least one full pay period after receiving a notice of levy on wages to begin withholding the required. If the percentage is 15 enter 15 as a decimal.

The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck. We help clients with IRS levies and other collection matters. This includes helping clients get levy releases.

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Tax changes as a result of the Tax Cuts and Jobs Act have altered the way.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. The levy is released. If you have a tax debt the irs can issue a levy.

Enter the percentage from section 2 b 1 of the Wage Garnishment Order may not exceed 15. For employees withholding is the amount of federal income tax withheld from your paycheck.

Irs Notice Cp91 Intent To Seize Social Security Benefits H R Block

Irs Wage Garnishment Eric Wilson Law

Irs Notice Cp21b Tax Defense Network

How To Calculate Wage Tax Levy

Irs Tax Notices Explained Landmark Tax Group

State And Irs Tax Relief Attorney Pittsburgh Pa Taxlane

Tax Penalty Interest Assistance Tax Penalty Lawyer Columbus Oh

Understanding Your Irs Form W 2

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

How To Calculate Payroll Taxes Tips For Small Business Owners Article

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

What Is Irs Wage Garnishment Understanding The Process Of Levying Wages

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros